LIC Jeevan Anand: ₹7K Monthly, ₹4.98L Returns

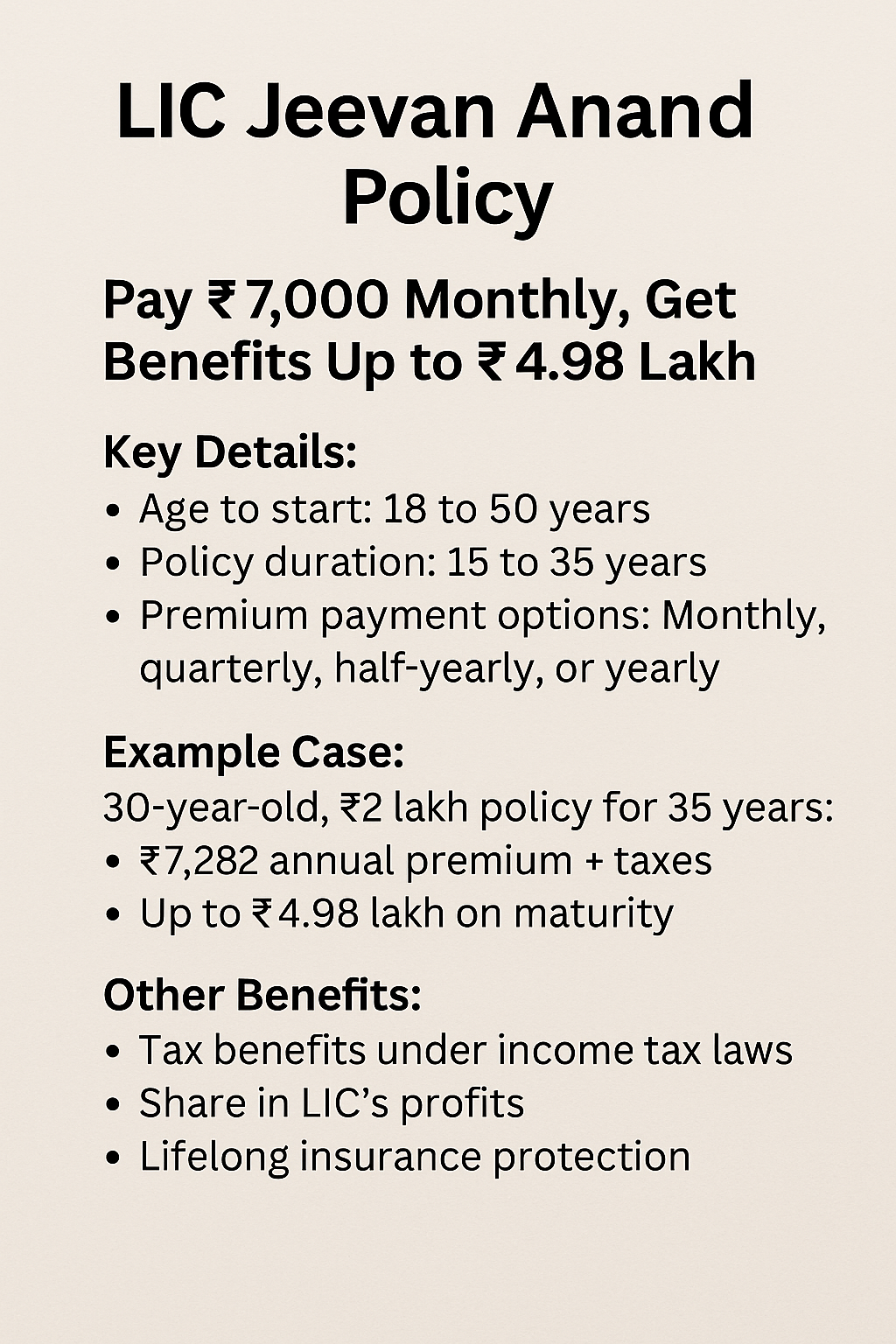

LIC Jeevan Anand Policy: Pay ₹7,000 Monthly, Get Benefits Up to ₹4.98 Lakh

Hyderabad: LIC’s Jeevan Anand is a life insurance plan that offers both savings and life cover. It provides financial benefits in two cases — if the policyholder dies or when the policy matures.

LIC agent Bandi Sadanand from Warangal explains that Jeevan Anand is a traditional endowment policy. It gives a guaranteed sum assured and bonuses. If the policyholder dies during the policy term, the nominee gets the insured amount. If the policy matures, the policyholder gets a lump sum.

One of the most popular options in the market is LIC Jeevan Anand, which combines the benefits of both insurance and savings.

Key Details:

- Age to start: 18 to 50 years

- Policy duration: 15 to 35 years

- Premium payment options: Monthly, quarterly, half-yearly, or yearly

- Surrender allowed after: 2 years

This policy also offers extra protection in case of an accident. If the policyholder dies in an accident, the nominee can get up to ₹5 lakh in addition to the insured amount. In case of permanent disability due to an accident, the benefit is paid in monthly parts.

Overall, the LIC Jeevan Anand plan is ideal for individuals looking for a reliable life insurance policy.

Example Case:

If a 30-year-old buys a ₹2 lakh Jeevan Anand policy for 35 years, the annual premium is ₹7,282 + taxes. On maturity, he can get up to ₹4.98 lakh. Even after the policy ends, the ₹2 lakh life cover continues for life.

In conclusion, choosing LIC Jeevan Anand not only secures your future but also provides peace of mind.

Other Benefits:

With LIC Jeevan Anand, policyholders can enjoy various benefits that enhance financial security.

- Tax benefits under income tax laws

- Share in LIC’s profits

- Long-term financial security for family

- Useful for tax planning

How to Apply:

To buy this policy, you’ll need:

- KYC documents (Aadhaar, PAN, address proof, age proof)

- Bank account details

- Medical reports

You can contact your nearest LIC branch or authorized LIC agent to apply.

About LIC:

Life Insurance Corporation of India is India’s largest government-owned insurer. Founded on September 1, 1956, LIC offers a variety of life insurance plans including term insurance, money-back plans, retirement and health policies.

ALSO READ | Gold Rate Today in Warangal